Use these links to rapidly review the documentTABLE OF CONTENTSTable of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | ||

Preliminary Proxy Statement | ||

Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

Definitive Proxy Statement |

Definitive Additional Materials |

Soliciting Material under §240.14a-12 |

Seagate Technology Public Limited Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

No fee required. | ||||

Fee computed on table below per Exchange Act Rules14a-6(i)(1)and 0-11. | ||||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

Fee paid previously with preliminary materials. | ||||

Check box if any part of the fee is offset as provided by Exchange ActRule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

September 4, 2015August 30, 2017

Dear Fellow Shareholder:

You are cordially invited to attend the 20152017 Annual General Meeting of Shareholders of Seagate Technology plc, which will be held at 9:30 a.m. local time on Wednesday, October 21, 2015,18, 2017, at the IntercontinentalInterContinental Hotel, Simmonscourt Road, Dublin 4, Ireland.

Details of the business to be presented at the meeting may be found in the Notice of Annual General Meeting of Shareholders and the Proxy Statement accompanying this letter.

We hope you are planning to attend the meeting. Your vote is important. Whether or not you plan to attend the meeting, please submit your proxy as soon as possible so that your shares may be represented at the 20152017 Annual General Meeting.

On behalf of the Board of Directors of Seagate Technology plc, I thank you for your continued support.

Sincerely,

Stephen J. Luczo

Chairman and Chief Executive Officer

2017 NOTICE OF MEETING AND PROXY STATEMENT |

SEAGATE TECHNOLOGY PUBLIC LIMITED COMPANY

NOTICE OF 20152017 ANNUAL GENERAL MEETING OF SHAREHOLDERS

The 20152017 Annual General Meeting of Shareholders of Seagate Technology plc ("Seagate"(“Seagate” or the "Company"“Company”), a company incorporated under the laws of Ireland, will be held on Wednesday, October 21, 2015,18, 2017, at 9:30 a.m. local time, at the IntercontinentalInterContinental Hotel, Simmonscourt Road, Dublin 4, Ireland.

The purposes of the 20152017 Annual General Meeting are:

General Proposals:

| 1. | By separate resolutions, to elect as directors the following incumbent directors who shall retire in accordance with the Articles of Association and, being eligible, offer themselves for election and to elect as a director (the “Director Nominees”): |

| (a) Stephen J. Luczo | (b) | (c) Michael R. Cannon | ||||

| (d)Mei-Wei Cheng | (e) William T. Coleman | (f) Jay L. Geldmacher | ||||

| (g) | (h) | (i) Stephanie Tilenius | ||||

| (j) |

| 2. | Approve, in an advisory,non-binding vote, the compensation of the Company’s named executive officers(“Say-on-Pay”). |

| 3. | Approve, in an advisory,non-binding vote, the frequency of futureSay-on-Pay votes (“Frequency ofSay-on-Pay”). |

| 4. | Approve an amendment and restatement of the Seagate Technology Public Limited Company Amended and Restated Employee Stock Purchase Plan (the “ESP Plan”) to increase the number of shares available for issuance. |

| 5. | Ratify, in anon-binding vote, the appointment of Ernst & Young LLP as the independent auditors of the Company and to authorize, in a binding vote, the Audit Committee of the Company’s board of directors (the “Board”) to set the auditors’ remuneration. |

Irish law. (Special Resolution).

| 6. | Grant the Board the authority to allot and/or issue shares under Irish law. |

| 7 | Grant the Board the authority toopt-out of statutorypre-emption rights under Irish law. |

| 8. | Determine the price range at which the Company canre-allot shares that it acquires as treasury shares under Irish law. |

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

Other:

| 9. | Conduct such other business properly brought before the meeting. |

The Board of Directors recommends that you vote "FOR" proposals“FOR” each director nominee included in Proposal 1 and “FOR” each of Proposals 2 and 4 through 4.8. For Proposal 3, the Board recommends you vote “FOR one year.” The full text of these proposals 1 through 4 is set forth in the accompanying proxy statement.Proxy Statement.

Proposals 1, 32, 4, 5 and 46 are ordinary resolutions, requiring the approval of a simple majority of the votes cast at the meeting. Proposal 2 is3 requires an affirmative vote of a plurality of all votes cast at the meeting. Proposals 7 and 8 are special resolution,resolutions, requiring the approval of not less than 75% of the votes cast.

Only shareholders of record as of the close of business on August 28, 2015,21, 2017 are entitled to receive notice of and to vote at the 2017 Annual General Meeting.Whether or not you plan to attend the meeting, pleasePlease provide your proxy by either usingeven if you plan on attending the Internet or telephone as further explainedmeeting. Instructions on how to vote your proxy are set forth in the accompanying proxy statement or filling in, signing, dating, and promptly mailing a proxy card.Proxy Statement.

During the meeting, following a review of Seagate’s business and affairs, management will also present Seagate'sSeagate’s Irish financial statements for the fiscal year ended July 3, 2015June 30, 2017 and the reports of the directors and auditors thereon.

By order of the Board,

Katherine E. Schuelke

Senior Vice President, Chief Legal Officer and Company Secretary

August 30, 2017

SEAGATE TECHNOLOGY PLC | ||||||

September 4, 2015

2017 NOTICE OF MEETING AND PROXY STATEMENT |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON OCTOBER 21, 2015:

18, 2017

We will be relying on the U.S. Securities and Exchange Commission (the “SEC”) rule that allows companies to furnish Proxy Materials over the Internet instead of mailing printed copies of those materials to each shareholder. As a result, we are sending our shareholders a Notice of Internet Availability of Proxy Materials (the "Notice"“Notice”) instead of a paper copy of our Proxy Statement, our Irish financial statements for the Company’s fiscal year 2015,ended June 30, 2017 (“fiscal year 2017”), the proxy card and our Annual Report onForm 10-K for fiscal year 20152017 (collectively, the "Proxy Materials"“Proxy Materials”). The Notice also contains instructions on how to request a paper copy of the Proxy Materials. If you have previously elected to receive our Proxy Materials electronically, you will continue to receive these materials via email unless you elect otherwise. A full printed set of our Proxy Materials will be mailed to you automatically only if you have previously made a permanent election to receive our Proxy Materials in printed form.

IF YOU ARE A SHAREHOLDER WHO IS ENTITLED TO ATTEND, SPEAK AND VOTE, THEN YOU ARE ENTITLED TO APPOINT A PROXY OR PROXIES TO ATTEND, SPEAK AND VOTE ON YOUR BEHALF. A PROXY IS NOT REQUIRED TO BE A SHAREHOLDER IN THE COMPANY. IF YOU WISH TO APPOINT AS PROXY ANY PERSON OTHER THAN THE INDIVIDUALS SPECIFIED ON THE PROXY CARD, PLEASE CONTACT THE COMPANY SECRETARY AT OUR REGISTERED OFFICE.

OFFICE AND ALSO NOTE THAT YOUR NOMINATED PROXY MUST ATTEND THE ANNUAL GENERAL MEETING IN PERSON IN ORDER FOR YOUR VOTES TO BE CAST.

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

This summary highlights information contained elsewhere in this Proxy Statement. For more complete information about the topics summarized below, please review Seagate Technology plc'splc’s Annual Report onForm 10-K and the entire Proxy Statement.

20152017 Annual General Meeting of Shareholders

| Date and Time: | Wednesday, October | |||

| Place: | Simmonscourt Road Dublin 4, Ireland | |||

Record Date: | August 21, 2017 | |||

| Voting: | Shareholders as of close of business on | |||

| Attendance: | All shareholders as of the close of business on the Record Date may attend the | |||

| Proxy Materials: | The Proxy Materials were first made available to shareholders on or about | |||

1

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

Proposals, voting recommendations and vote required:

The Board of Directors recommends that you vote "FOR"“FOR” each of the proposals that will be submitted for shareholder approval at the 2015 Annual General Meeting.2017 AGM.

The proposals are: | Vote required: | Page: | ||||||

|---|---|---|---|---|---|---|---|---|

| 1 | By separate resolutions, to elect the 11 director nominees named in the proxy statement. | Ordinary Resolutions Majority of votes cast | 12 | |||||

2 | To determine the price range at which the Company can re-issue shares that it holds as treasury shares under Irish law. | Special Resolution At least 75% of votes cast | 18 | |||||

3 | To approve, in an advisory, non-binding vote, the compensation of the Company's named executive officers. | Ordinary Resolution Majority of votes cast | 19 | |||||

4 | To ratify, in an advisory, non-binding vote, the appointment of Ernst & Young LLP as the independent auditors of the Company for the fiscal year ending July 1, 2016 ("fiscal year 2016") and to authorize, in a binding vote, the Audit Committee of the Board of Directors to set the auditors' remuneration. | Ordinary Resolution Majority of votes cast | 20 | |||||

| Proposals: | Vote required: | Board Recommendation | ||||

1. | Election of each of the 10 Director Nominees | Majority of Votes Cast | FOR each nominee | |||

2. | Advisory Vote onSay-on-Pay | Majority of Votes Cast | FOR | |||

3. | Advisory Vote on the Frequency ofSay-on-Pay | Affirmative Plurality of Votes Cast | FOR one year | |||

4. | Amendment and Restatement of the ESP Plan to increase the number of shares available for issuance | Majority of Votes Cast | FOR | |||

5. | Ratification of the Appointment and Remuneration of Auditors | Majority of Votes Cast | FOR | |||

6. | Grant Board Authority to Allot and/or Issue Shares | Majority of Votes Cast | FOR | |||

7. | Grant Board Authority toOpt-out of StatutoryPre-emption Rights | 75% of Votes Cast | FOR | |||

8. | Determine the Price Range for theRe-Allotment of Treasury Shares | 75% of Votes Cast | FOR | |||

TableDuring the meeting, following a review of ContentsSeagate’s business and affairs, management will also present Seagate’s Irish financial statements for the fiscal year 2017 and the reports of the directors and statutory auditors thereon.

Seagate'sSeagate’s Corporate Governance Highlights

• The Board | • The Board | |

• Directors must receive a majority of shareholder votes cast to be elected. | • The

| |

• Directors and executive officers are subject to share ownership guidelines. | • Executive officers are subject to a | |

• All directors are elected annually by shareholders. | • The Company maintains ananti-hedging policy for all directors and employees. | |

• The Board | • The Board | |

• The Board | ||

2

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement

|

Director Nominees

2017 NOTICE OF MEETING AND PROXY STATEMENT |

Director Nominees.

We are asking our shareholders to elect, by separate resolutions, each of the director nomineesDirector Nominees described below:

| Nominee | Age |

Director Since | Principal Occupation | Independent | Current Committee Membership | |||||||

Stephen J. Luczo

| 60 | 2000 | Chairman and Chief Executive Officer of Seagate Technology plc | No | • None | |||||||

Mark W. Adams

| 53 | 2017 | Chief Executive Officer of Lumileds, Inc. | Yes | • Audit | |||||||

Michael R. Cannon

| 64 | 2011 | Former President, Global Operations, Dell, Inc. | Yes | • Compensation • Nominating and Corporate Governance (Chair) | |||||||

Mei-Wei Cheng

| 67 | 2012 | FormerNon-Executive Chairman of Pactera Technology International Ltd. | Yes | • Audit • Finance | |||||||

3

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

| Nominee | Age |

Director Since | Principal Occupation | Independent | Current Committee Membership | |||||||

William T. Coleman

| 69 | 2012 | Chief Executive Officer of Veritas Technologies LLC | Yes | • Finance • Nominating and Corporate Governance | |||||||

Jay L. Geldmacher

| 61 | 2012 | Chief Executive Officer of Artesyn Embedded Technologies | Yes | • Compensation | |||||||

William D. Mosley

| 51 | 2017 | President and Chief Operating Officer of Seagate Technology plc | No | • None | |||||||

Dr. Chong Sup Park

| 69 | 2006 | Former Chairman and Chief Executive Officer of Maxtor Corp. | Yes | • Audit (Chair) • Nominating and Corporate Governance | |||||||

Nominee | Age | Director Since | Principal Occupation | Independent | Current Committee Membership | |||||

|---|---|---|---|---|---|---|---|---|---|---|

Stephen J. Luczo | 58 | 2000 | Chairman and Chief Executive Officer of Seagate Technology plc | No | • None | |||||

Frank J. Biondi, Jr. | 70 | 2005 | Senior Managing Director of WaterView Advisors LLC | Yes | • Compensation • Finance (Chair) | |||||

Michael R. Cannon | 62 | 2011 | Former President, Global Operations, Dell, Inc. | Yes | • Audit • Nominating and Corporate Governance (Chair) |

4

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

Nominee | Age | Director Since | Principal Occupation | Independent | Current Committee Membership | |||||

|---|---|---|---|---|---|---|---|---|---|---|

Mei-Wei Cheng | 65 | 2012 | Non-Executive Chairman of Pactera Technology International Ltd. | Yes | • Audit • Finance | |||||

William T. Coleman | 67 | 2012 | Partner with Alsop Louie Partners | Yes | • Finance • Nominating and Corporate Governance | |||||

Jay L. Geldmacher | 59 | 2012 | CEO of Artesyn Embedded Technologies | Yes | • Compensation | |||||

Dr. Dambisa F. Moyo | 46 | Nominee | International Economist and Commentator | Yes | • None | |||||

Kristen M. Onken | 66 | 2011 | Former Senior Vice President, Finance and Chief Financial Officer of Logitech International, SA | Yes | • Audit (Chair) | |||||

| Nominee | Age |

Director Since | Principal Occupation | Independent | Current Committee Membership | |||||||

Stephanie Tilenius

| 50 | 2014 | Chief Executive Officer andCo-Founder of Vida Health, Inc. | Yes | • Finance • Nominating and Corporate Governance | |||||||

Edward J. Zander

| 70 | 2009 | Former Chairman and Chief Executive Officer of Motorola, Inc. | Yes | • Compensation (Chair) | |||||||

Nominee | Age | Director Since | Principal Occupation | Independent | Current Committee Membership | |||||

|---|---|---|---|---|---|---|---|---|---|---|

Dr. Chong Sup Park | 67 | 2006 | Former Chairman and CEO of Maxtor | Yes | • Compensation • Nominating and Corporate Governance | |||||

Stephanie Tilenius | 48 | 2014 | Co-Founder and CEO of Vida Health, Inc. | Yes | • Finance • Nominating and Corporate Governance | |||||

Edward J. Zander | 68 | 2009 | Former Chairman and CEO of Motorola, Inc. | Yes | • Compensation (Chair) |

For further biographical information about our director nomineesDirector Nominees, see pages 12 through 17biographical information starting on page 15 of this Proxy Statement.

Determine the price range at which the Company can re-issue shares held as treasury shares.

We are asking you to determine the price range at which the Company can re-issue shares held as treasury shares. From time to time the Company may acquire ordinary shares and hold them as treasury shares. The Company may re-issue such treasury shares, and under Irish law, our shareholders must authorize the price range at which we may re-issue any shares held in treasury. As required under Irish law, this must be approved by special resolution, and requires the affirmative vote of at least 75% of the votes cast.

Advisory Approval of the Compensation of Our Executives.Say-on-Pay Proposal.

We are asking for your advisory approval of the compensation of our named executive officers (our "NEOs."“NEOs”). as required by Section 14A of the Securities Exchange Act of 1934 (the “Exchange Act”) and the related rules of the SEC. While our Board of Directors intends to carefully consider the shareholder vote resulting from the proposal, the final vote will not be binding on us and is advisory in nature.

Before considering this proposal, please read our "Compensation“Compensation Discussion and Analysis,"Analysis” starting on page 36, which explains our executive compensation programs and the Compensation Committee'sCommittee’s compensation decisions.

TableAdvisory Approval of Contentsthe Frequency ofSay-on-Pay Proposal.

We are asking you to indicate how frequently we should seek an advisory vote on the compensation of our NEOs. This proposal is also referred to as the Frequency ofSay-on-Pay proposal. The Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”) requires that we solicit your advisory vote with respect to the Frequency ofSay-on-Pay every six years. At our 2011 Annual General Meeting, our shareholders indicated that they would preferSay-on-Pay votes to occur annually and we have heldSay-on-Pay votes every year since that time. You may indicate whether you would prefer aSay-on-Pay vote every one year, two years, or three years, or you may abstain from voting on this proposal. The Board believes that continuing to hold an advisory vote on executive compensation annually is aligned with our policy of seeking feedback from you on corporate governance, our compensation policies, practices and philosophy for our NEOs.

5

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

You may cast your vote on your preferred voting frequency by choosing any of the following four options with respect to this proposal: “every one year,” “two years,” “three years,” or “abstain.” We are asking you to vote for a frequency of “every one year.”

While our Board intends to carefully consider the shareholder vote resulting from the proposal, the final vote will not be binding on us and is advisory in nature.

Before considering this proposal, please read our “Compensation Discussion and Analysis” starting on page 36, which explains our executive compensation programs and the Compensation Committee’s compensation decisions.

Approval of our Amended and Restated Employee Stock Purchase Plan.

We are asking you to approve the amendment and restatement of our ESP Plan, which increases the number of shares reserved for issuance under the current plan by 10,000,000 and to make certain administrative updates. A detailed discussion about the amendments is included in Proposal 4, starting on page 70.

Ratification of the appointment of Ernst & Young LLP, and authorization to set auditors'auditors’ remuneration.

We are asking you to ratify the appointment of Ernst & Young LLP as our auditors, and to authorize the Audit Committee to set their remuneration.

Grant the Board authority to allot and/or issue shares.

We are asking you to grant our Board authority to allot and/or issue shares under Irish law. This authority is fundamental to our business and granting the Board this authority is a routine matter for public companies incorporated in Ireland. Under Irish law, this proposal must be approved by ordinary resolution, which requires the affirmative vote of a simple majority of the votes cast.

Grant the Board authority toopt-out of statutorypre-emption rights.

We are asking you to grant the Board authority to allot and/or issue shares for cash without first offering them to existing shareholders. This authority is fundamental to our business and granting the Board this authority is a routine matter for public companies incorporated in Ireland. Under Irish law, this proposal must be approved by special resolution, which requires the affirmative vote of at least 75% of the votes cast.

Determine the price range at which the Company canre-allot shares held as treasury shares.

We are asking you to determine the price range at which the Company canre-allot shares held as treasury shares. From time to time, the Company may acquire ordinary shares and hold them as treasury shares. The Company mayre-allot such treasury shares, and under Irish law, our shareholders must authorize the price range at which we mayre-allot any shares held in treasury. Under Irish law this proposal must be approved by special resolution, which requires the affirmative vote of at least 75% of the votes cast.

Executive Compensation

Pay for PerformancePay-for-Performance

The general philosophy and structure of our executive compensation programs emphasize strong alignment between executive pay and corporate financial performance. In addition, our compensation

6

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

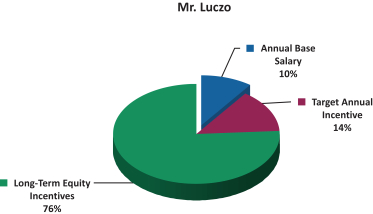

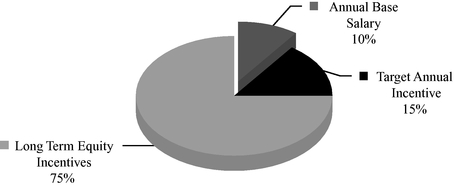

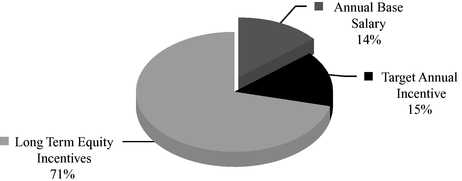

philosophy is designed to align our executive compensation programs with long term shareholder interests. In the Company'sCompany’s fiscal year ended July 3, 2015 ("fiscal year 2015"),2017, a majority of our long term equity incentive awards were granted in the form of performance basedperformance-based restricted share units, which vest dependent upon the achievement ofpre-established performance objectives, including return on invested capital, relative total shareholder return and adjusted earnings per share, reflecting a strong emphasis on pay for performancepay-for-performance and the alignment of interests between our NEOs and our shareholders. In addition, over 88%at least 86% of our NEO total annual targeted compensation is at-risk.at risk.

Highlights of fiscal year 2015 financial performance include:

Please review our "Compensation“Compensation Discussion and Analysis"Analysis” for additional information and definitions of financial metrics.

Table of Contents2018 AGM

2016 AGM

Deadline for shareholder proposals for inclusion in the | May | |

Period for shareholder nomination of directors: | April | |

Deadline for all other proposals: | July |

For further information, see the section entitled "Shareholder“Shareholder Proposals and Nominations"Nominations” on page 82 of this Proxy.Proxy Statement.

7

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

| 10 | ||||

| 15 | ||||

| 15 | ||||

| 21 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 30 | ||||

| 33 | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 33 | |||

| 36 | ||||

| 36 | ||||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 39 | ||||

Role of our CEO and Management in the Decision-Making Process | 40 | |||

| 40 | ||||

| 40 | ||||

| 43 | ||||

| 44 | ||||

| 46 | ||||

| 50 | ||||

| 50 | ||||

| 51 | ||||

| 52 | ||||

| 53 | ||||

| 54 | ||||

| 54 | ||||

| 55 | ||||

| 56 | ||||

| 57 | ||||

| 60 | ||||

| 60 | ||||

Potential Payments Upon Qualifying Termination or Change in Control | 61 | |||

PROPOSAL 2 – AN ADVISORY, NON-BINDING VOTE ON THE COMPANY’S EXECUTIVE COMPENSATION –SAY-ON-PAY VOTE | 68 | |||

| 69 | ||||

| 70 |

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

| ||||

| ||||

Fees Paid to Independent Auditors

| ||||

| ||||

| ||||

| ||||

EQUITY COMPENSATION PLAN INFORMATION

| ||||

SHAREHOLDER PROPOSALS AND NOMINATIONS

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

APPENDIX A: | A-1 | |||

| B-1 |

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

PROXY STATEMENT

In this Proxy Statement, "Seagate“Seagate Technology," "Seagate,"” “Seagate,” the "Company," "we," "us"“Company,” “we,” “us” and "our"“our” refer to Seagate Technology plc, an Irish public limited company. This Proxy Statement and the enclosed proxy card, or the Notice of Internet Availability of Proxy Materials, are first being mailed to shareholders of record at the close of business on August 28, 2015 (the "Record Date")the Record Date on or about September 4, 2015.August 30, 2017.

Following are questions and answers concerning voting and solicitation and other general information.

Why did I receive this Proxy Statement? | We sent you this Proxy Statement or a Notice of Internet Availability of Proxy Materials | |

This Proxy Statement summarizes the information you need to know to vote on an informed basis. | ||

Why are there two sets of financial statements covering the same fiscal period? | U.S. securities laws require us to send you our | |

What do I need to do to attend the | All shareholders as of the Record Date are invited to attend the | |

10

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

Who may vote? | You are entitled to vote if you |

How do I vote? | Shareholders of record can cast their votes by proxy by: | ||

• using the Internet and voting at www.proxyvote.com; | |||

• calling 1.800.690.6903 and following the telephone prompts; or | |||

• completing, signing and returning a proxy card by | |||

If you have received a Notice, it contains a control number that will allow you to access the Proxy Materials online. If you have received a paper copy of our Proxy Materials, a printed proxy card has been enclosed. If you have not received a paper copy of our Proxy Materials and wish to vote by mail, please follow the instructions included in the Notice to obtain a paper proxy card. A full printed set of our Proxy Materials will be mailed to you automatically only if you have previously made a permanent election to receive our Proxy Materials in printed form. | |||

The Notice is not a proxy card and it cannot be used to vote your shares. | |||

Shareholders of record may also vote their shares directly by attending the | |||

| |||

In order to be timely processed, your vote must be received by | |||

May I revoke my proxy? | If you are a registered holder of the | ||

• notifying the Company Secretary in writing: c/o Seagate Technology plc at 38/39 Fitzwilliam Square, Dublin 2, Ireland, Attention: Company Secretary; | |||

• submitting another properly signed proxy card with a later date or another Internet or telephone proxy at a later date but prior to the close of voting described above; or | |||

• by voting in person at the | |||

11

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

| Merely attending the |

If you are not a registered holder but your shares are registered in the name of a nominee, you must contact the nominee to revoke your proxy. Merely attending or attempting to vote in person at the 2017 AGM will not revoke your proxy if your shares are held in the name of a nominee. | |||

How will my proxy get voted? | If your proxy is properly submitted, you are legally designating the person or persons named in the proxy card to vote your shares as you have directed. Unless you name a different person or persons to act as your proxy, | ||

If you are a The following proposals areroutine matters: • Proposal 5 (Ratification of the Appointment and Remuneration of Auditors) • Proposal 6 (Grant Board Authority to Allot and/or Issue Shares) • Proposal 7 (Grant Board Authority toOpt-out of StatutoryPre-emption Rights) • Proposal 8 (Determine Price Range for theRe-allotment of Treasury Shares) However, your bank, broker-dealer brokerage firm, trust or other similar organization or nominee may not vote your shares on The following proposals arenon-routine matters: • Proposal 1 (Election of each of the 10 Director Nominees) • Proposal 2 (Advisory Vote onSay-on-Pay) • Proposal 3 (Advisory Vote on the Frequency ofSay-on-Pay) • Proposal 4 (Amendment and Restatement of the ESP Plan to increase the number of shares available for issuance) | |||

12

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

What constitutes a quorum? | The presence (in person or by proxy) of shareholders entitled to exercise a majority of the voting power of the Company on the Record Date is necessary to constitute a quorum to conduct business for the | |

What vote is required to approve each of the proposals? |

• Proposal 1 (Election of each of the • Proposal 2 (Advisory Vote onSay-on-Pay) • Proposal 4 (Amendment and • Proposal 5 (Ratification of the • Proposal 75% of Votes Cast Required to Approve: • Proposal 7 (Grant the • Proposal 8 (Determine the Price Range for Affirmative Plurality of Votes Cast Required to Approve: • Proposal 3 (Advisory Vote on the Frequency ofSay-on-Pay) | |

Although abstentions and brokernon-votes are counted as | ||

Who pays the expenses of this | We have hired Morrow | ||

How will voting be counted on any other matters that may be presented at the | Although we do not know of any matters to be presented or acted upon at the | ||

Board recommendations. | The Board | ||

13

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

Voting procedures and tabulation. | The Board |

14

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

PROPOSALS 1(a) – 1(k)1(j) – ELECTION OF DIRECTORS

(Ordinary Resolutions)

The Company uses a majority of votes cast standard for the election of directors. A majority of the votes cast means that the number of votes cast "for"“for” a director nominee must exceed the number of votes cast "against"“against” that director nominee. Each of the Board of Directors nomineesDirector Nominees is being nominated for election for aone-year term beginning at the end of the 20152017 AGM to be held on October 21, 201518, 2017 and expiring at the end of the 2016 AGM.2018 Annual General Meeting of Shareholders (the “2018 AGM”).

Under our Articles of Association, if a director is notre-elected in a director election, then that director will not be appointed and the position on the Board of Directors that would have been elected or filled by the director nominee will, except in limited circumstances, become vacant. The Board of Directors has the ability to fill the vacancy in accordance with the Articles of Association, subject to approval by the Company'sCompany’s shareholders at the next AGMannual general meeting of Shareholders.shareholders.

Notwithstanding the requirement that a director nominee requires a majority of the votes cast, as Irish law requires a minimum of two directors at all times, in the event that an election results in either only one or no directors receiving the required majority vote, either the nominee or each of the two nominees, as appropriate, receiving the greatest number of votes in favor of his or her election shall, in accordance with the Company'sCompany’s Articles of Association, hold office until his or her successor(s) shall be elected.

The Board of Directors recommends that you vote "FOR" each of the following nominees:THE BOARD RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE FOLLOWING NOMINEES:

(a) | Stephen J. Luczo—age | Mr. Luczo has been our On October 1, 2017, Mr. Luczo will step down from his position as CEO of Seagate and become our Executive Chairman. |

15

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

| Expertise:As our CEO, Mr. Luczo brings significant expertise to our Board |

(b) Mark W. Adams – age 53, Director since 2017 | Mark W. Adams has | ||||

Expertise:Mr. | |||||

(c) Michael R. Cannon—age | Mr. Cannon served as President, Global Operations of Dell Inc. from February 2007 until his retirement in January 2009, and as | ||||

16

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

| Expertise:Mr. Cannon has extensive industry expertise, including expertise in the disk drive business that is invaluable to our |

(d) Mei-Wei | Mr. Cheng | ||||

Expertise: | |||||

(e) William | Mr. Coleman has been CEO of Veritas Technologies LLC since January 2016. He was a partner with Alsop Louie Partners, a venture capital firm that invests in early stage technology, | ||||

Mr. Coleman previously founded BEA Systems, Inc., an enterprise application and service infrastructure software provider, where he served as Chairman of the Board from 1995 | |||||

17

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

Expertise:As a partner of a private equity firm and |

Table of Contentsexperience.

(f) | Jay L. Geldmacher—age | Since November 2013, Mr. Geldmacher has served as CEO of Artesyn Embedded Technologies, a spin off from the Embedded Computing and Power business of Emerson | ||

Expertise: | As a CEO, Mr. Geldmacher brings international, technological, and operational expertise to our Board, | |||

(g) William D. Mosley—age 51, Director since 2017 | Mr. Mosley has been our COO since June 2016 and On October 1, 2017, Mr. Mosley will become our CEO. Expertise: As our COO, Mr. Mosley is directly responsible for the Company’s operations. With his broad-based executive-level experience andin-depth understanding of | |||

18

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

(h) Dr. Chong Sup Park—age | Dr. Chong Sup Park served as Chairman and CEO of Maxtor from November 2004 until May 2006, as Chairman of | |||

Expertise: | As a former board chair and CEO, and having held other senior management positions with other companies, Dr. Park | |||

(i) Stephanie Tilenius—age | Ms. Tilenius is a | ||||

Expertise: | Ms. Tilenius is an experienced senior executive in the consumer internet sector. She contributes her leadership, strategic insight, digital and | ||||

19

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

(j) Edward J. Zander—age | Mr. Zander served as Chairman and CEO of Motorola, Inc. from January 2004 until January 2008, when he retired as CEO and continued as Chairman. He resigned as Chairman in May 2008. Prior to joining Motorola, Mr. Zander was a Managing Director of Silver Lake Partners, a leading private equity fund focused on investments in technology industries from July 2003 to December 2003. Mr. Zander was President and COO of Sun Microsystems Inc., a leading provider of hardware, software and services for networks, from October 1987 until June 2002. Within the past five years, Mr. Zander has served as a member of the board of directors of NetSuite, Inc. | ||

Expertise: | Mr. Zander brings financial, technological, sales and marketing, and research and development expertise to our Board | ||

There isare no familyfamilial relationships between any of the directors, director nomineesDirector Nominees or our executive officers, nor are any of our directors, director nomineesDirector Nominees or executive officers party to any legal proceedings adverse to us.

PROPOSAL 2 – DETERMINE THE PRICE RANGE AT WHICH THE COMPANYCAN RE-ISSUE SHARES HELD AS TREASURY SHARES(Special Resolution)

20

Our open-market share repurchases and other share buyback activities, all effected by way of redemptions in accordance with our Articles of Association, may result in ordinary shares being acquired and held by the Company as treasury shares. We may re-issue treasury shares that we acquire through our various share buyback activities including in connection with our executive and director compensation programs.

Under Irish law, our shareholders must authorize the price range at which we may re-issue any shares held in treasury. In this Proposal, that price range is expressed as a minimum and maximum percentage of the closing market price of our ordinary shares on the NASDAQ the day preceding the day on which the relevant share is re-issued. Under Irish law, this authorization must expire no later than 18 months after its passing unless renewed.

"RESOLVED, that for purposes of Section 1078 of the Companies Act 2014, the re-allotment price at which any treasury shares (as defined by Section 106(1) of the Companies Act of 2014) held by the Company may be re-allotted off-market shall be as follows:

(a) The maximum price at which a treasury share may be re-allotted off-market shall be an amount equal to 120% of the closing price on the NASDAQ for shares of that class on the day preceding the day on which the relevant share is re-allotted by Seagate.

(b) The minimum price at which a treasury share may be re-allotted shall be the nominal value of the share where such a share is required to satisfy an obligation under an employees' share scheme (as defined under Section 64(1) of the Companies Act 2014) or any share incentive plan operated by Seagate or, in all other cases, an amount equal to 90% of the closing price on the NASDAQ for shares of that class on the day preceding the day on which the relevant share is re-allotted by Seagate.

(c) The re-allotment price range as determined by paragraphs (a) and (b) shall expire eighteen months from the date of the passing of this resolution, unless previously varied, revoked or renewed in accordance with the provisions of Section 1078 of the Companies Act 2014."

The affirmative vote of not less than 75% of the votes cast by holders of ordinary shares represented in person or by proxy at the 2015 AGM is necessary to approve Proposal 2 regarding the price range at which Seagate may re-issue any treasury shares in off-market transactions.

The Board of Directors recommends that shareholders vote "FOR" the proposal to determine the price at which the Company can reissue shares held as treasury shares.

PROPOSAL 3 – AN ADVISORY, NON-BINDING VOTE ON THE COMPANY'SEXECUTIVE COMPENSATION

The Board of Directors is presenting the following Proposal, commonly known as a "Say-on-Pay" proposal, which gives you as a shareholder the opportunity to endorse or not endorse, in an advisory, non-binding vote, the compensation of our named executive officers, as required by Section 14A of the Exchange Act and the related rules of the SEC. The Board of Directors currently intends to hold such votes annually. Accordingly, the next such vote will be held at the Company's 2016 Annual General Meeting. You may endorse or not endorse, respectively, the compensation paid to our named executive officers by voting for or against the following resolution:

"RESOLVED, that, on an advisory, non-binding basis, the compensation of the Company's named executive officers, as disclosed in the Compensation Discussion and Analysis, the accompanying compensation tables and the related disclosure contained in the Company's proxy statement is hereby approved."

While our Board of Directors intends to carefully consider the shareholder vote resulting from the proposal, the final vote will not be binding, and is advisory in nature.

In considering your vote, please be advised that our compensation program for our named executive officers is guided by our design principles, as described in the Compensation Discussion and Analysis of this Proxy Statement:

The Board of Directors recommends that you vote "FOR" the advisory, non-binding approval of the compensation of our named executive officers as disclosed in the Compensation Discussion and Analysis, the accompanying compensation tables, and the related disclosure contained in this Proxy Statement.

PROPOSAL 4 – NON-BINDING RATIFICATION OF APPOINTMENT OF ERNST & YOUNG LLPAND BINDING AUTHORIZATION OF AUDIT COMMITTEE TO SET AUDITORS' REMUNERATION

At the 2015 AGM, shareholders will be asked to approve the appointment of Ernst & Young LLP as our independent auditors for the fiscal year ending July 1, 2016, and to authorize the Audit Committee of our Board of Directors to set the independent auditors' remuneration. Ernst & Young LLP has been acting as our independent auditors for many years and, both by virtue of its long familiarity with the Company's affairs and its ability, is considered best qualified to perform this important function.

Representatives of Ernst & Young LLP will be present at the 2015 AGM and will be available to respond to appropriate questions. They will have an opportunity to make a statement if they so desire.

The Board of Directors recommends a vote "FOR" the proposal to approve the appointment of Ernst & Young LLP as independent auditors of the Company and to authorize the Audit Committee of the Board of Directors to set the auditors' remuneration.

Our management is responsible for preparing and presenting our financial statements, and our independent auditors, Ernst & Young LLP, are responsible for performing an independent audit of our annual consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB) and for auditing the effectiveness of our internal control over financial reporting as of the end of our fiscal year. One of the Audit Committee's responsibilities is to monitor and oversee these processes. In connection with the preparation of the financial statements as of and for the fiscal year ended July 3, 2015, the Audit Committee performed the following tasks:

Based upon these reviews and discussions, the Audit Committee recommended, and the Board of Directors approved, that our audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended July 3, 2015, for filing with the SEC.

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

Fees Paid to Independent Auditors

The aggregate fees paid or accrued by us for professional services provided by Ernst & Young LLP in fiscal years ended July 03, 2015 and June 27, 2014 are set forth below.

| | Fiscal Year | ||||||

|---|---|---|---|---|---|---|---|

| | 2015 | 2014 | |||||

| | (In thousands) | ||||||

Audit Fees | $ | 6,170 | $ | 6,438 | |||

Audit-Related Fees | 331 | 869 | |||||

Tax Fees | 46 | 309 | |||||

All Other Fees | 18 | 8 | |||||

| | | | | | | | |

Total | $ | 6,565 | $ | 7,624 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Audit Fees. This category consists of professional services provided in connection with the integrated audit of our annual consolidated financial statements and the audit of internal control over financial reporting, the review of our unaudited quarterly consolidated financial statements, and audit services that are normally provided by the independent registered public accounting firm in connection with statutory and regulatory filings or engagements for those fiscal years. The fees for fiscal year 2015 included audit activities related to the acquisition of LSI's flash business and services in connection with our debt offerings, and in fiscal year 2014 included audit activities related to the acquisition of Xyratex Ltd and services in connection with our debt offerings.

Audit-Related Fees. This category consists of assurance and related services provided by Ernst & Young LLP that were reasonably related to the performance of the audit or review of our consolidated financial statements and which are not reported above under "Audit Fees". For fiscal years 2015 and 2014, this category includes: pension plan and grant or similar audits, agreed upon procedures engagements, and advisement on accounting matters that arose during those years in connection with the preparation of our annual and quarterly consolidated financial statements and fees related to due diligence procedures.

Tax Fees. This category consists primarily of professional services provided by Ernst & Young LLP primarily for tax compliance for fiscal years 2015 and 2014.

All Other Fees. This category consists of fees for the use of Ernst & Young LLP's online accounting research tool and iXBRL tagging services performed for fiscal years 2015 and 2014.

In fiscal years 2015 and 2014, all audit, audit related, tax and all other fees were pre-approved by the Audit Committee. Under the SEC rules, subject to certain permitted de minimis criteria, pre-approval is required for all professional services rendered by the Company's principal accountant. We are in compliance with these SEC rules. In making its recommendation to ratify the appointment of Ernst & Young LLP as our independent auditors for fiscal year 2016, the Audit Committee considered whether the services provided to us by Ernst & Young LLP are compatible with maintaining the independence of Ernst & Young LLP from us. The Audit Committee has determined that the provision of these services by Ernst & Young LLP is compatible with maintaining that independence.

Pre-Approval of Services by Independent Auditors

The Audit Committee pre-approves all audit and other permitted non-audit services provided to us by our independent auditors. These services may include audit services, audit-related services, tax services and other permissible non-audit services. The Audit Committee may also pre-approve particular services on a case-by-case basis. The Audit Committee has delegated the authority to grant pre-approvals to the Audit Committee Chair when the full Audit Committee is unable to do so. These pre-approvals are reviewed by the full Audit Committee at its next regular meeting. Our independent auditors and senior management periodically report to the Audit Committee regarding the extent of services provided by the independent auditors.

Corporate Governance Guidelines

Our Corporate Governance Guidelines, together with the Board of Directors committee charters, provide the framework for the corporate governance of the Company. Following is a summary of our Corporate Governance Guidelines. Our Corporate Governance Guidelines, as well as the charters of each of our Board committees, are available on our website at www.seagate.com, under "Investors—Corporate“Investors - Governance."”

Role of the Board of Directors

The Board, of Directors, elected annually by our shareholders, directs and oversees the management of the business and affairs of the Company. In this oversight role, the Board of Directors serves as the ultimatedecision-making body of the Company, except for those matters reserved to the shareholders.

The Board of Directors and its Committeescommittees have the primary responsibilities of:

Board Leadership Structure

The Board of Directors generally believes that the offices of Chairman and CEO should be held by separate persons to aid in the oversight of management, unless it is in the best interests of the Company that the same person holds both offices. The Board of Directors believes that having Mr. Luczo serving inWhile the combined role of Chairman and CEO has worked well for the Company, the Board believes that from a strategic and governance perspective, it is in the most effective structure forbest interests of the Company, at this time, to separate the offices of the CEO and Chairman. The Board believes that it has worked well forits succession strategy, with the Company.appointment of William D. Mosley as CEO effective October 1, 2017, and as a director of the Board effective July 25, 2017, will benefit from and be enhanced by Mr. Luczo’s continued service as the Chairman of the Board. The Board believes that the separation of the offices of the CEO and Chairman will ensure an effective implementation of its succession strategy. It is the Board of Directors'Board’s view that the Company'sCompany’s corporate governance principles, the quality, stature and substantive business knowledge of the members of the Board, of Directors, as well as the Board of Directors'Board’s culture of open communication with the CEO and senior management are currently conducive to Board of Directors effectiveness with a combinedthe separation of the Chairman and CEO position.positions.

In addition, the Board of Directors hascontinues to retain a Lead Independent Director and it believes this role addresses the need for independent leadership and perspective in addition to an organizational structure for

21

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

the independent directors. The Board of Directors appoints the Lead Independent Director each year after the AGMannual general meeting for an aone-year term from among the Board of Directors' independent directors. term. The Lead Independent Director coordinates the activities of the othernon-employee directors, presides over meetings of the Board of Directors at which the Chairman of the Board is not present and at each executive session, facilitates the CEO evaluation process, serves as liaison between the Chairman of the Board and the independent directors, approves meeting schedules and agendas for the Board, of Directors, has authority to call meetings of the independent directors, and is available for consultation and direct communication if requested by major shareholders.

Dr. ParkMr. Cannon has served as our Lead Independent Director since October 26, 201119, 2016 having been re-appointedappointed by the Board of Directors annually sinceon that date.

Board Risk Oversight

The Board of Directors has oversight responsibility of the processes established to report and monitor systems for material risks applicable to the Company. The Board of Directors and its committees focus on the Company'sCompany’s general risk management strategy and the most significant risks facing the Company and ensure that appropriate risk mitigation strategies are implemented by management. The full Board of Directors is responsible for considering strategic risks and succession planning, and the committees oversee other categories of risk including:

Finally, as part of its oversight of the Company'sCompany’s executive compensation program, the Compensation Committee considers the impact of the Company'sCompany’s executive compensation program and the incentives created by the compensation awards that it administers on the Company'sCompany’s risk profile. In addition, the Company reviews all of its compensation policies and procedures, including the incentives that they create and factors that may reduce the likelihood of excessive risk taking, to determine whether they present a significant risk to the Company. Based on this review, the Company has concluded that its compensation policies and procedures are not reasonably likely to have a material adverse effect on the Company.

Director Compensation and Share Ownership

It is the Board of Directors'Board’s practice to maintain a fair and straightforward compensation program at the Board of Directors level, which is designed to be competitive with compensation programs from comparable companies. The Compensation Committee recommends and administers the policies that govern the level and form of director compensation, with oversight from the independent directors. In addition, the Compensation Committee believes that a substantial portion of the total director compensation package should be in the form of equity in the Company in order to better align the interests of the Company'sCompany’s directors with thelong-term interests of its shareholders. As such, the directors are subject to a share ownership requirement of four times the annual cash retainer paid to the directors as described in more detail later in this Proxy Statement.

22

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

Board Composition

The Board of Directors consists of a substantial majority of independent,non-employee directors. In addition, our Corporate Governance Guidelines require that all members of the standing committees of the Board of Directors must be independent directors. The Board of Directors has the following four standing committees: Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee, and Finance Committee. The Board of Directors has determined that each member of each of these committees is "independent"“independent” as defined in the NASDAQ listing standards and that each member of the Compensation Committee and Audit Committee meet applicable NASDAQ and SEC independence standards for such committees. Committee memberships and chairs are rotated periodically.

Table of Contentsperiodically and an independence analysis is conducted annually.

Board Diversity

While theThe Board of Directors has not adopted a formal policy with regard to the consideration of diversity in identifying director nominees, thenominees. The Nominating and Corporate Governance Committee considers the skills, expertise and background of director nominees. The Nominating and Corporate Governance Committee seeks director nominees that would complement and enhance the effectiveness of the existing Board of Directors and ensure that its members are appropriately diverse and consists of members with various and relevant backgrounds, skills, knowledge, perspectives and experience.experiences.

Board Advisors

The Board of Directors and its committees may, under their respective charters, retain their own external and independent advisors to carry out their responsibilities. For fiscal year 2017, the Compensation Committee retained FW Cook as its external and independent advisor.

Executive Sessions

The Company'sCompany’s independent directors meet privately in regularly scheduled executive sessions of the Board of Directors and Committees,committees, without management present, to consider such matters as the independent directors deem appropriate. These executive sessions are typically held at each Board of Directors and Committeecommittee meeting.

Board Evaluation

The Nominating and Corporate Governance Committee assists the Board of Directors in periodically evaluating its performance and the performance of the Board committees. Each committee also conducts periodic self-evaluation.self-evaluation and the Board conducts periodicpeer-to-peer evaluations. The effectiveness of individual directors is considered each year when the Board of Directors nominates directors to stand for election.

Director Orientation and Education

The Company has developed an orientation program for new directors and reimburses directors for continuing education. In addition, the directors are given full access to management and other employees as a means of providing additional information.

Director Nomination Process

The Nominating and Corporate Governance Committee reviews the composition of the full Board of Directors to identify the qualifications and areas of expertise needed to further enhance the composition of the Board, of Directors,

23

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

makes recommendations to the Board of Directors concerning the appropriate size and needs of the Board of Directors and, on its own, with the assistance of other Board of Directors members or management, a search firm or others, identifies candidates with those qualifications. The Board reviews and considers the Nominating and Corporate Governance Committee’s recommendations and determines the Director Nominations. In considering candidates, the Nominating and Corporate Governance Committee takes into account all factors it considers appropriate, including breadth ofprofessional experience, understanding of business and financial issues, ability to exercise sound judgment, diversity, leadership, and achievements, knowledge and experience in matters affecting business and industry. The Nominating and Corporate Governance Committee considers the entirety of each candidate'scandidate’s credentials and believes that at a minimum, each nominee should satisfy the following criteria: highest character and integrity, experience and understanding of strategy, sufficient time to devote to Board of Directors matters, and no conflict of interest that would interfere with performance as a director. The Nominating and Corporate Governance Committee seeks to ensure that the Board of Directors is composed of members whose particular expertise, qualifications, attributes and skills, when taken together, allow the Board of Directors to satisfy its oversight responsibilities effectively. Shareholders may recommend candidates for consideration for Board of Directors membership by sending the recommendation to the Nominating and Corporate Governance Committee, care of the Company Secretary. Candidates recommended by shareholders are evaluated in the same manner as director candidates identified by any other means.

Term Limits and Retirement

The Board of Directors does not have a mandatory retirement age for directors and, because the Nominating and Corporate Governance Committee annually evaluates director nominees for the following year, the Board of Directors has decided not to adopt arbitrary term limits for its directors.

Director Independence

The Board, based on its review and the recommendation of Directorsthe Nominating and Corporate Governance Committee, has determined that all of our current directors and director nominees,Director Nominees, except Stephen J. Luczo and William D. Mosley, who is an employeeare employees of the Company, are independent under the NASDAQ listing standards and the Corporate Governance Guidelines, which are consistent with the NASDAQ listing standards. When assessing director independence, the Board of Directors considers the various commercial, charitable and employment transactions and relationships known to the Board of Directors (including those identified through annual directors'directors questionnaires) that exist between the Company and the entities with which our directors or members of their immediate families are, or have been, affiliated. The Board of Directors evaluated certain transactions that arose in the ordinary course of business between the Company and such entities and which occurred on the same terms and conditions available to other customers and suppliers. After reviewing these transactions and such other information as the Board of Directors deemed advisable, the Board of Directors determined that Messrs. Biondi,Adams, Cannon, Cheng, Coleman, Geldmacher Reyes and Zander, Mses. Onken andMs. Tilenius and Drs.Dr. Park and Moyo are independent under both the Company'sCompany’s Corporate Governance Guidelines and the applicable NASDAQ rules.

Director Changes

On October 19, 2016, Ms. Kristen M. Onken did not stand forre-election at the 2016 AGM. Mr. Gregorio Reyes, currently servingAdams was appointed as a member of our Board and of Directorsthe Audit Committee effective January 19, 2017 and Mr. Mosley was appointed as a member of our Board effective July 25, 2017. The Board believes that the appointments of Messrs. Adams and Mosley enhance the overall effectiveness of the Board.

Dr. Dambisa F. Moyo and Mr. Frank J. Biondi, Jr., currently serving as members of our Board, will retirenot stand forre-election to our Board at the 2015conclusion of their terms at the 2017 AGM. This is not due to any disagreement with the Company'sCompany’s management or Board of Directors.Board.

24

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

Communications with Directors

Shareholders and other interested parties wishing to communicate with the Board, of Directors, thenon-employee directors or any individual director (including our Lead Independent Director and any Committee Chair) may do so by sending a communication to the Board of Directors and/or a particular member of the Board, of Directors, care of the Company Secretary.Secretary at Seagate Technology plc, 10200 S. De Anza Boulevard, Cupertino, California 95014. Depending upon the nature of the communication and to whom it is directed, the Company Secretary will: (a) forward the communication to the appropriate director or directors; (b) forward the communication to the relevant department within the Company; or (c) attempt to handle the matter directly (for example, a communication dealing with a share ownership matter).

The Company has adopted a Code of Ethics applicable to the Chief Executive Officer,CEO, the Chief Financial Officer,CFO, and the principal accounting officer or controller or persons performing similar functions ofat Seagate Technology plc. The Code of Ethics is available atwww.seagate.com, under "Investors."“Investors - Governance.” Amendments to, or waivers of the Code of Ethics will be disclosed promptly on our website or on a current report onForm 8-K. No such waivers were requested or granted in the fiscal year 2015.2017.

Securities Trading Policy and Other Restrictions

The Company prohibits its directors and executive officers from (i) purchasing any financial instruments designed to hedge or offset any decrease in the market value of Company securities and (ii) engaging in any form ofshort-term speculative trading in Company securities. Directors and

executive officers are also prohibited from holding Company securities in a margin account or pledging Company securities as collateral for a loan unless the General CounselChief Legal Officer or the Chief Financial Officer providespre-clearance after the director or executive officer clearly demonstrates the financial capability to repay the loan without resort to the pledged securities.

The following sets forth the name, age and position of each of the persons who were serving as executive officers as of September 4, 2015. There are no family relationships among any of our executive officers.25

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement | |||||

2017 NOTICE OF MEETING AND PROXY STATEMENT |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Our Board has adopted a written policy for approval of transactions with our directors, Director Nominees, executive officers, shareholders that beneficially own more than 5% of our shares and immediate family members of such persons (each, a “Related Person”). Pursuant to the policy, if any Related Person has a direct or indirect material interest in a transaction or potential transaction in which the amount involved exceeds $120,000, he or she must promptly report it to the Chief Legal Officer of the Company or her designee. The Nominating and Corporate Governance Committee then reviews any such transactions and determines whether or not to approve or ratify them. In doing so, the Nominating and Corporate Governance Committee takes into account, among other factors it deems to be appropriate, the extent of the Related Person’s interest; whether the transaction would interfere with the Related Person’s judgment in fulfilling his or her duties to the Company; whether the transaction is fair to the Company and on terms no less favorable than terms generally available to an unaffiliated third party under similar circumstances; whether the transaction is in the interest of the Company and its shareholders; and whether the transaction would present an improper conflict of interest.

In addition, if the transaction involves a director, the Nominating and Corporate Governance Committee will consider whether such transaction would impact such director’s independence under NASDAQ rules or qualifications to serve on committees under the Company’s Corporate Governance Guidelines and applicable NASDAQ and SEC rules. The Board has delegated authority to the Chair of the Nominating and Corporate Governance Committee to review and approve or ratify transactions where the aggregate amount is expected to be less than $1 million. A summary of any new transactions approved by the Chair is provided to the full Nominating and Corporate Governance Committee for its review at the next scheduled committee meeting after such approval.

Josip Relota, Mr. Luczo’sbrother-in-law, is employed as a software engineer by the Company. In connection with such employment, Mr. Relota receives a total annual cash compensation of approximately $204,186 and a retention bonus of $92,787. In addition, Mr. Relota is eligible to participate in our general employee benefit plans, including vacation and health plans. The Company’s Nominating and Corporate Governance Committee has ratified the terms of Mr. Relota’s employment and compensation.

On September 19, 2016, the Company entered into a Board Observer Rights Agreement (the “Observer Rights Agreement”) with ValueAct Capital Master Fund L.P. (“ValueAct”) which beneficially owns more than 5% of the Company’s ordinary shares as of August 11, 2017. Pursuant to the Observer Rights Agreement, ValueAct is entitled to one seat as a board observer provided that it continue to own not less than 2% of the ordinary shares of the Company. This board observer right was granted to ValueAct in connection with ValueAct’s purchase of 9.5 million ordinary shares of the Company. Under the terms of the Observer Rights Agreement, the Board retains the right to limit access to information and attendance at portions of the Board meetings at the Board’s discretion and ValueAct is required to comply with the terms of the Confidentiality Agreement with the Company, which was entered into on the same day. ValueAct was not a related party of the Company at the time the Company entered into these agreements.

26

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

|

Stephen J. Luczo. Mr. Luczo, 58, has served as our CEO since January 2009 and as Chairman of the Board since 2002. Mr. Luczo joined Seagate in October 1993 as Senior Vice President of Corporate Development. In September 1997, he was promoted to President and Chief Operating Officer of Seagate Technology (Seagate Technology plc's predecessor) and, in July 1998, he was promoted to CEO at which time he joined the Board as a director of Seagate Technology. Mr. Luczo resigned as CEO effective as of July 2004, but remained as Chairman of the Board. He served as non-employee Chairman from October 2006 to January 2009. From October 2006 until he rejoined us in January 2009, Mr. Luczo was a private investor. Mr. Luczo also served as our President from January 2009 until October 2013. Prior to joining Seagate in 1993, Mr. Luczo was Senior Managing Director of the Global Technology Group of Bear, Stearns & Co. Inc., an investment banking firm, from February 1992 to October 1993. Mr. Luczo served on the board of directors of Microsoft Corporation from May 2012 to March 2014.

Philip G. Brace. Mr. Brace, 44, has served as our President, Cloud Systems and Electronics Solutions since July 22, 2015. Mr. Brace joined Seagate in September 2, 2014 as Executive Vice President and Chief Technology Officer of Silicon Solutions, and was promoted to Interim President of Cloud Systems and Electronics Solutions on April 30, 2015. He was previously employed by LSI Corporation ("LSI") from August 2005 through September 2014. At LSI, he was the Executive Vice President of the Storage Solutions Group from July 2012 to September 2014, Senior Vice President and General Manager from January 2009 to July 2012, and Senior Vice President of Corporate Planning and Marketing from August 2005 to January 2009.

William D. Mosley. Mr. Mosley, 49, has served as our President, Operations and Technology since October 2013 and as Executive Vice President, Operations from March 2011 until October 2013. Prior to that, he served as Executive Vice President, Sales and Marketing from September 2009 through March 2011; Executive Vice President, Sales, Marketing and Product Line Management from February 2009 to September 2009; Senior Vice President, Global Disk Storage Operations from 2007 to 2009; and Vice President, Research and Development, Engineering from 2002 to 2007.

Albert A. "Rocky" Pimentel. Mr. Pimentel, 60, has served as our President of Global Markets and Customers since October 2013 and as Executive Vice President, Chief Sales and Marketing Officer from April 2011 until October 2013. Prior to that, Mr. Pimentel served as a director of Seagate from 2009 until his resignation from the Board of Directors in April 2011. Mr. Pimentel served as Chief Operating Officer and Chief Financial Officer ("CFO") at McAfee, Inc., from 2008 until he retired in August 2010. He served as the Executive Vice President and CFO of Glu Mobile from 2004 to 2008. Prior to joining Glu Mobile, Mr. Pimentel served as Executive Vice President and CFO at Zone Labs from 2003 to 2004, which was acquired by Check Point Software in 2004.

Patrick J. O'Malley. Mr. O'Malley, 53, has served as our Executive Vice President and Chief Financial Officer since August 2008. Previously, he served as our Senior Vice President, Finance from 2005 to August 2008. Prior to that, he was our Senior Vice President, Consumer Electronics from 2004 to 2005.

Mark Re. Mr. Re, 55, has served as our Senior Vice President, Research and Development since July 2013. Prior to that, he served as our Vice President, Research, from August 2003 to August 2006. Mr. Re currently serves on the Scientific Advisory Board for the Data Storage Institute, as well as on the Pittsburgh Technology Council and the Advanced Storage Technology Consortium.

Douglas DeHaan. Mr. DeHaan, 57, has been our General Manager, Samsung HDD Products since September 2012. Prior to that, he served as our Senior Vice President, Operations and Materials, from February 2009 until September 2012; Senior Vice President of Quality from 2008 to 2009; and Senior Vice President of Product and Process Development, Core Products, from 2003 to 2008.

David H. Morton Jr. Mr. Morton, 43, has served as our Senior Vice President, Finance, Treasurer and Principal Accounting Officer since April 2014 and our Vice President, Finance, Treasurer and Principal Accounting Officer from October 2009 to April 2014; Vice President of Finance, Sales and Marketing from March 2009 to October 2009; Vice President of Sales Operations from July 2007 to March 2009; Vice President of Finance, Storage Markets from October 2006 to July 2007; Executive Director of Consumer Electronics Finance from October 2005 to October 2006; and Executive Director of Corporate FP&A from June 2004 to October 2005.

Regan J. MacPherson. Ms. MacPherson, 52, has served as our Vice President and Interim General Counsel since August 2015. She served as Deputy General Counsel from September 2013 until August 2015. Prior to that, she was Assistant General Counsel from 2010 through 2013, Associate General Counsel from 2008 to 2010 and a Senior Manager in Legal from 2005 to 2008.

Audit Committee

Members: Dr. Chong Sup Park, Chair

Mark W. Adams

Members:Mei-Wei Kristen M. Onken, ChairMichael R. CannonMei-Wei ChengGregorio Reyes

Dr. Dambisa F. Moyo

Key Functions:

The Board of Directors has determined that all current members of the Audit Committee meet the applicable NASDAQ and SEC standards for membership on the Audit Committee, and that each of Dr. Park, Mr. Cannon,Adams, Mr. Cheng and Ms. OnkenDr. Moyo is an audit committee financial expert, as that term is defined by rules of the SEC.

A copy of the charter of the Audit Committee is available on our website,www.seagate.com, under the heading "Investors—Corporate“Investors - Governance."”

Compensation Committee

Members: Edward J. Zander, Chair

Frank J. Biondi, Jr.

Michael R. Cannon

Jay L. GeldmacherChong Sup Park

Key Functions:

27

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

| based on this evaluation. The Compensation Committee Chair presents all compensation decisions pertaining to the CEO to the full Board, however, all compensation decisions related to the CEO are determined by the Board’s independent directors. |

The Compensation Committee may form subcommittees composed of two or more of its members for any purpose the Compensation Committee deems appropriate and may delegate to such subcommittees such power and authority as the Compensation Committee deems appropriate. In addition, the Compensation Committee may delegate to one or more officers of the Company the authority to make grants and awards of cash or equity securities to any employee who is not a Section 16 officer of the Company under the Company’s incentive-compensation or other equity-based plans, provided that such delegation is in compliance with such plan, the Company’s Articles of Association and applicable law.

For a discussion concerning the processes and procedures for determining executive and director compensation and the role of executive officers and compensation consultants in determining or recommending the amount or form of compensation, see "Compensation“Compensation Discussion and Analysis"Analysis” and "Compensation“Compensation of Directors,"” respectively.

The Board has determined that each member of the Compensation Committee meets all applicable NASDAQ and SEC standards for membership on the Compensation Committee. In addition, the Board has determined that each member of the Compensation Committee qualifies as a "Non-Employee Director"“Non-Employee Director” within the meaning ofRule 16b-3 of the Securities Exchange Act of 1934

and an "outside director"“outside director” within the meaning of Section 162(m) of the Internal Revenue Code of 1986 (the "Code"“Code”).

A copy of the charter of the Compensation Committee is available on our website,www.seagate.com, under the heading "Investors—Corporate“Investors - Governance."”

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee during fiscal year 2015: was an employee of the Company or any of its subsidiaries at any time during fiscal year 2015, has ever been an executive officer of the Company or any of its subsidiaries, or had a relationship with the Company during that period requiring disclosure pursuant to Item 404(a) of Regulation S-K. No executive officers of the Company served on the compensation committee of any other entity, or as a director of an entity that employed any of the members of the Compensation Committee during fiscal year 2015.

Nominating and Corporate Governance Committee

Members: Michael R. Cannon, Chair

William T. Coleman

Dr. Chong Sup Park

Stephanie Tilenius

Key Functions:

28

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |

2017 NOTICE OF MEETING AND PROXY STATEMENT |

The Board has determined that each member of the Corporate Governance and Nominating Committee is "independent"“independent” as defined in the NASDAQ listing standards and the Company'sCompany’s Corporate Governance Guidelines.

A copy of the charter of the Corporate Governance and Nominating Committee is available on our website,www.seagate.com, under the heading "Investors—Corporate“Investors - Governance."”

Finance Committee

Members: Frank J. Biondi, Jr., Chair

Mei-Wei Cheng

William T. ColemanGregorio Reyes

Dr. Dambisa F. Moyo

Stephanie Tilenius

Key Functions:

The Board has determined that each member of the Finance Committee is "independent"“independent” as defined in the NASDAQ listing standards and the Company'sCompany’s Corporate Governance Guidelines.

A copy of the charter of the Finance Committee is available on our website,www.seagate.com, under the heading "Investors—Corporate“Investors - Governance."”

Board, Committee and Annual Meeting Attendance

The Board of Directors and its committees held the following number of meetings during the fiscal year ended July 3, 2015:June 30, 2017:

Board | 6 | |||

Audit Committee | 6 | |||

Compensation Committee | 6 | |||

Nominating and Corporate Governance Committee | 4 | |||

| ||||

| ||||

| ||||

|

Each incumbent director attended over 75% or more of the total number of meetings of the Board of Directors and the committees on which he or she served during the fiscal year 2015.2017. The Company's Company’snon-employee directors

29

SEAGATE TECHNOLOGY PLC | 2017 Proxy Statement |